SASSA Payment Schedule vs Bank Clearance: Why Delays Happen

Understanding the SASSA Payment Schedule vs Bank Clearance is crucial for beneficiaries, but many still experience delays due to bank processes. While SASSA releases payments on fixed dates, the actual time money reflects in your account often depends on your bank’s processing speed and verification checks.

To avoid confusion, doing a regular sassa status check can help you track whether your payment has been released or is still pending. In this guide, we’ll explain why these delays happen, how long they usually take, and what you can do to manage your payments more effectively.

What’s the Difference Between “Payment Date” and “Clearance Date”?

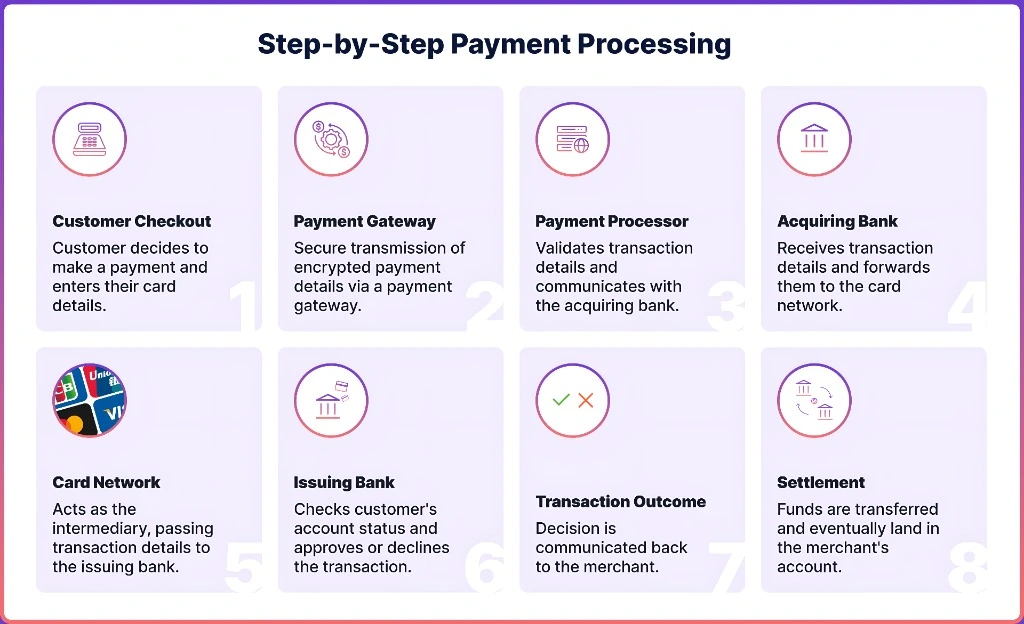

The Journey of a Grant Payment (Step by Step)

Ever wondered what happens behind the scenes after you apply for a SASSA grant? The process may seem simple, but every stage matters. From application and verification to approval, release, and finally receiving funds in your bank account, each step ensures transparency and security. In this guide, we’ll break down the journey of a grant payment step by step so you can clearly understand how long it takes, why delays happen, and how to track your funds through SASSA Status Check and Payment Dates effectively.

SASSA or its payment processor sends funds in batches to multiple banks, and this is where the SASSA Payment Schedule vs Bank Clearance process can cause delays.

Banks exchange and process funds through national clearing systems.

Your bank runs checks: account validity, name match, and fraud filters.

Once verified, the bank posts the money to your account.

Some banks send SMS or app alerts once the deposit clears.

Because the process involves several layers, a small delay at any point can push your clearance date.

Main Causes of Delay (Beyond What Most People Think)

When Delays Are Common

What You Can Do to Minimize (or Recover From) Delays

Sample Timeline: What Should Happen (Ideal Case)

| Day | What Happens | What You Can Check |

|---|---|---|

| Day 0 | SASSA dispatches payment | “Sent” status visible on your account |

| Day 1 | Bank verifies and processes | Check online or app balance |

| Day 1–2 | Posting and clearance | Funds should appear in your account |

| Day 3+ | Hold, review, or verification delay | Contact SASSA or bank |

If it’s been more than three business days since the scheduled payment date, you should escalate your case.

FAQs

Final Thoughts

Delays between the SASSA payment schedule and actual bank clearance are normal but avoidable if your account information and details are correct. Most payments clear within 24–48 hours after the scheduled date.